Lessons for Economics Shift

SUMMARY: Accurate bookkeeping and accounting are essential for businesses to secure bank loans and investor financing, especially during economic shifts when financial scrutiny increases. Hiring a professional accountant ensures organized financial records, tax...

Audit Checklist: Keeping it Smooth

SUMMARY: A nonprofit audit checklist helps organizations prepare for financial audits by organizing key documents such as financial statements, tax filings, and internal control policies. It ensures the audit process is smooth, promotes transparency, and reassures...

The Role of a Financial Committee

SUMMARY: A financial committee ensures an organization’s financial health through budget oversight, internal controls, and long-term planning. However, they can become ineffective due to a lack of financial expertise, irregular meetings, over-reliance on leadership,...

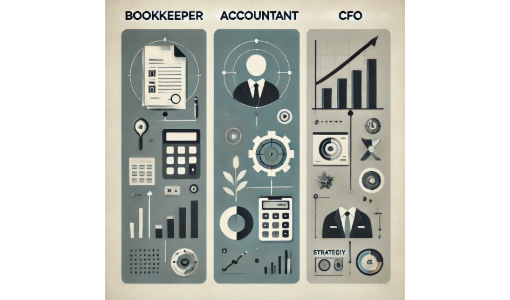

Difference Between Bookkeeper, Accountant, & CFO

SUMMARYA bookkeeper handles day-to-day financial transactions, an accountant ensures compliance and produces reports, while a CFO provides strategic financial leadership in a nonprofit organization. A seasoned CFO understands the importance of all three roles,...